Summary

The federal debt has risen due to prolonged excessive spending and insufficient revenue generation. Both major political parties are contributing to this fiscal imbalance, either through tax cuts that increase deficits or spending on policy proposals neither of which have offsetting cuts to pay for them.

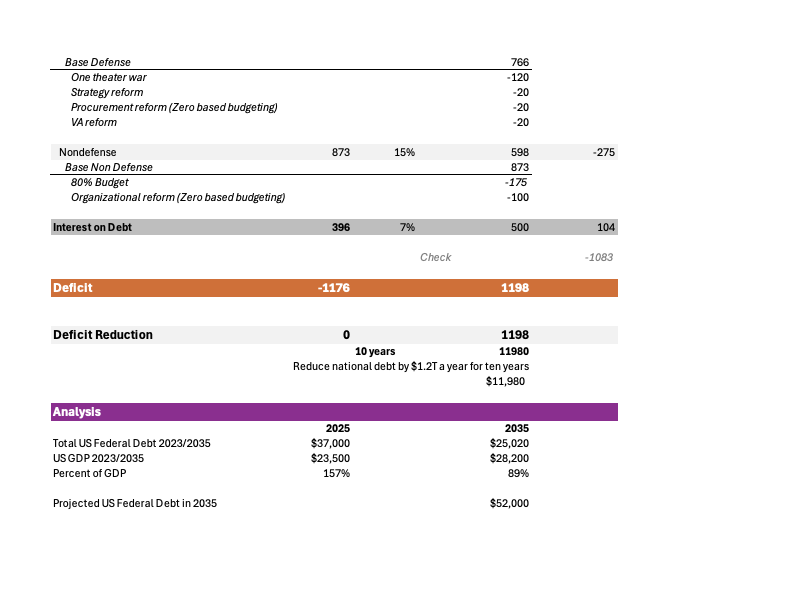

We propose a two-pronged strategy to remedy this problem: first, establish a credible, balanced debt reduction plan over the next decade that includes both revenue enhancements and spending cuts; second, amend the Constitution to mandate balanced federal budgets when the debt exceeds 90% of GDP. This would limit excessive borrowing and require a supermajority in Congress for any emergency borrowing.

We also recommend exploring a consumption tax, reforming entitlement programs to reflect demographic shifts, and increasing efficiency in military spending. We recommend restoring higher tax brackets for wealthier individuals and raising the corporate tax rate to ensure a fair contribution from corporations.

What’s required is a bipartisan approach to fiscal responsibility and we propose a 2027 budget that aims to foster collaboration among Americans while promoting a government that operates within its financial limits.

Details

The Problem

The elephant in the room for the United States is the staggering size of its federal debt, a result of decades of uncontrolled and reckless spending despite many promises of reigning in the cost of government and the funding required to pay for it. The simple reality is the federal government is both spending well beyond its means, and failing to collect enough revenue to pay for what it budgets year in and year out. This is true with both parties and there’s is very little to suggest it will end, especially with the latest Republican tax bill which actually INCREASES deficit spending while attempting to cloak those increases with legislative legerdemain. Bond markets are the ultimate arbiter of this fiscal reality and they do not agree with the sanguine assertion that the bill won’t create massive deficits and a much larger federal debt. It will.

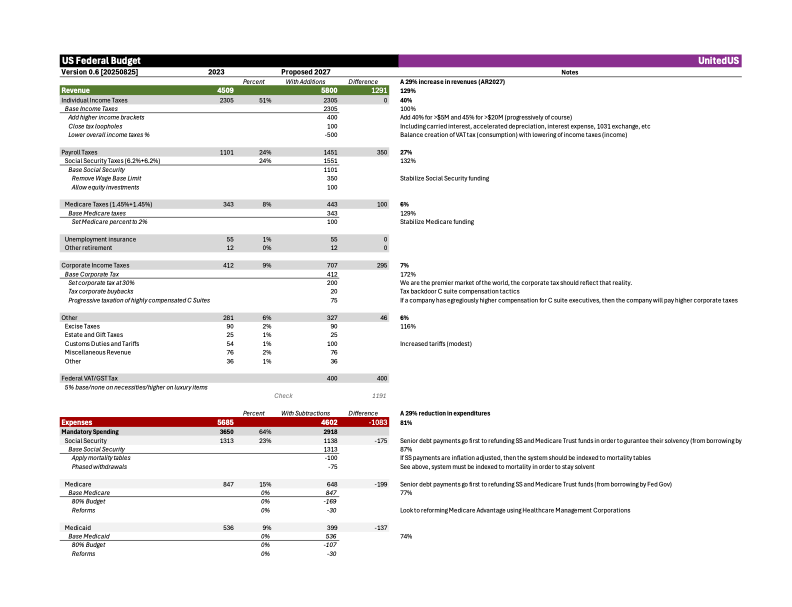

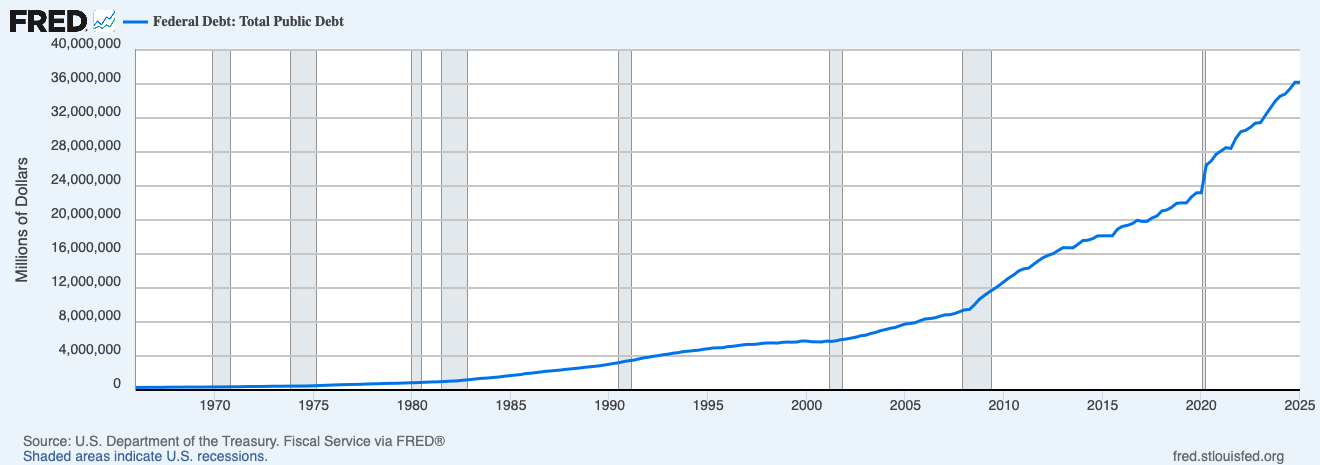

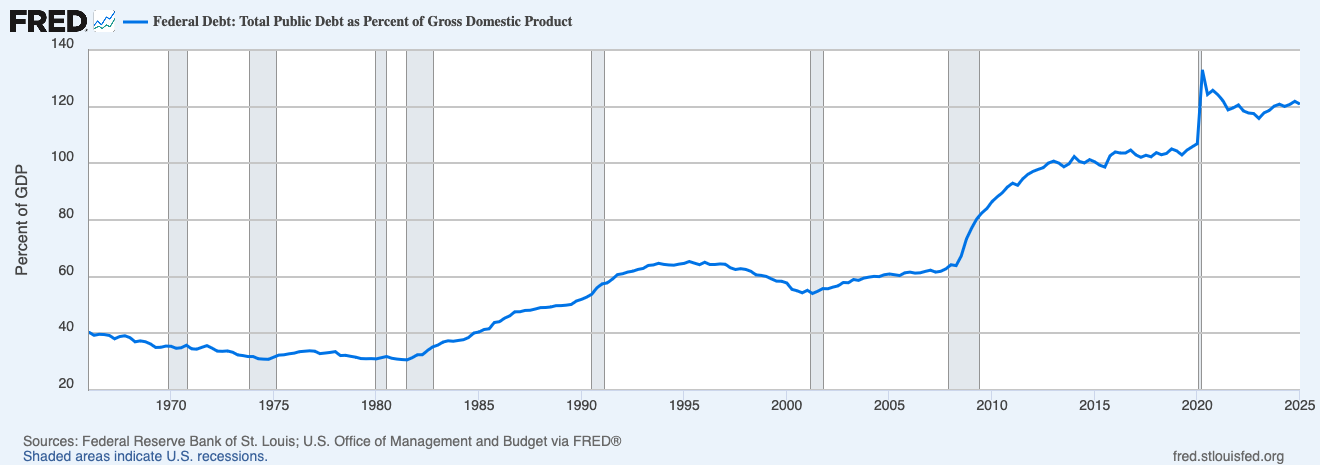

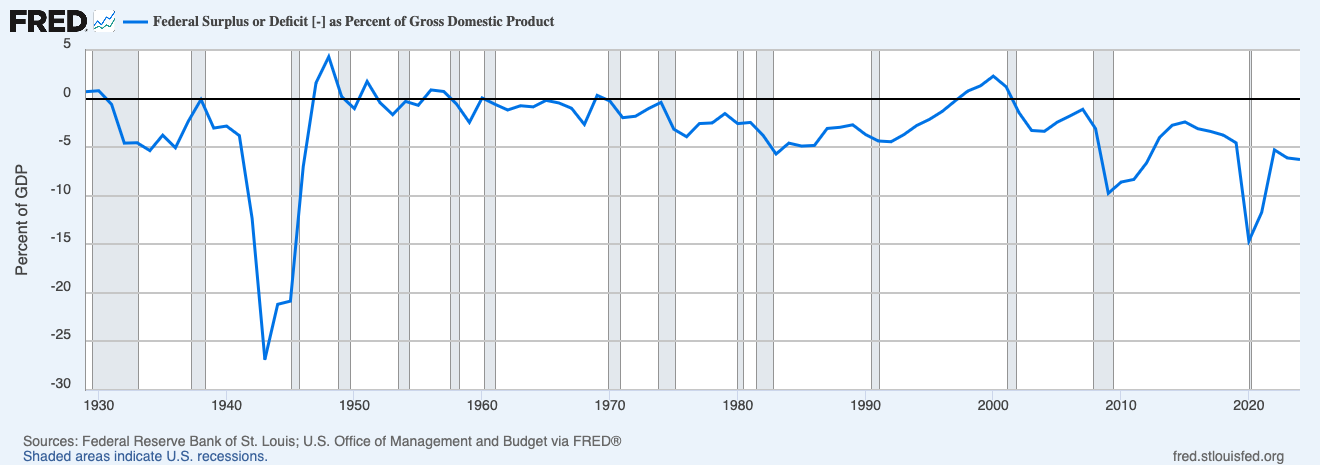

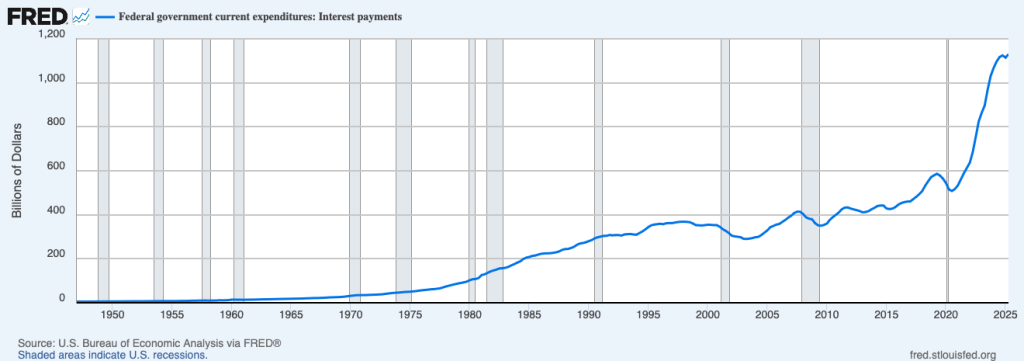

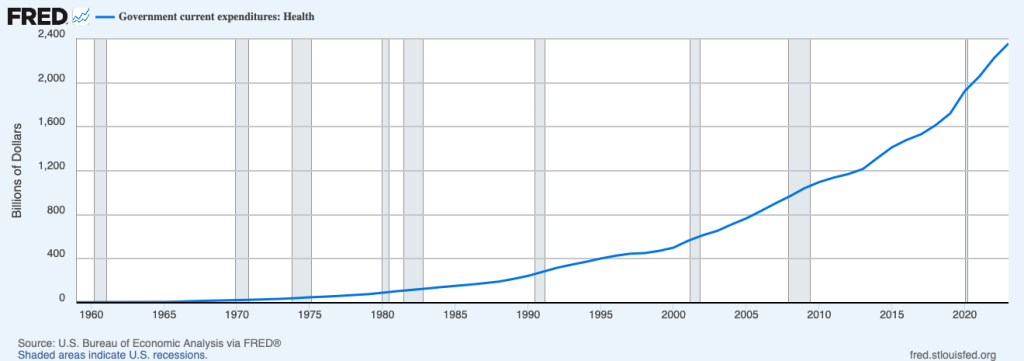

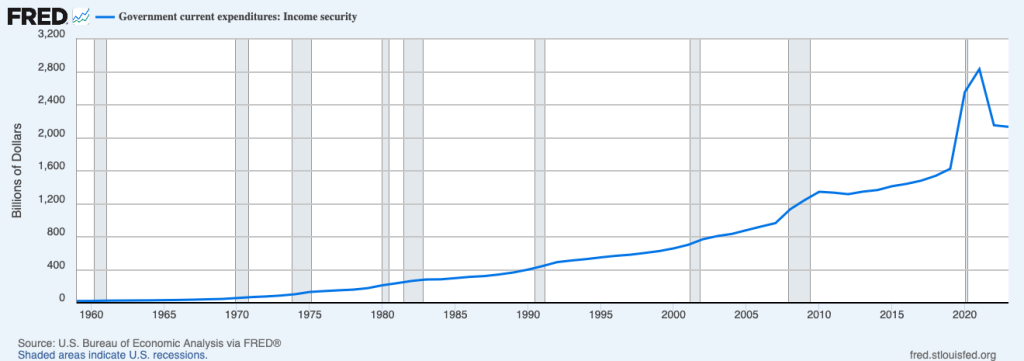

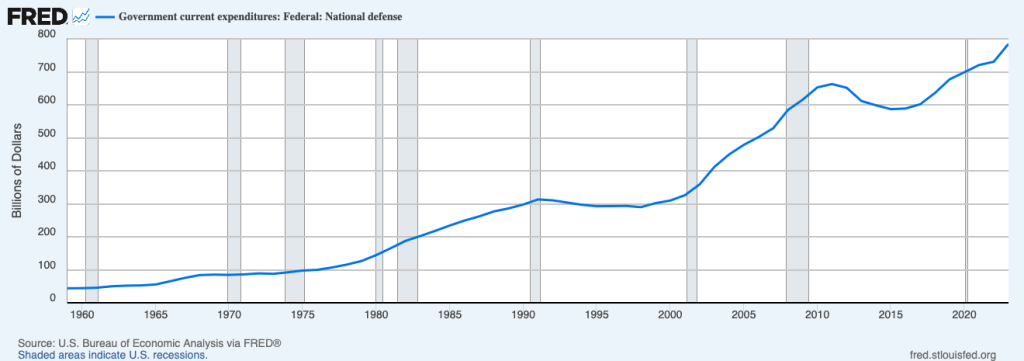

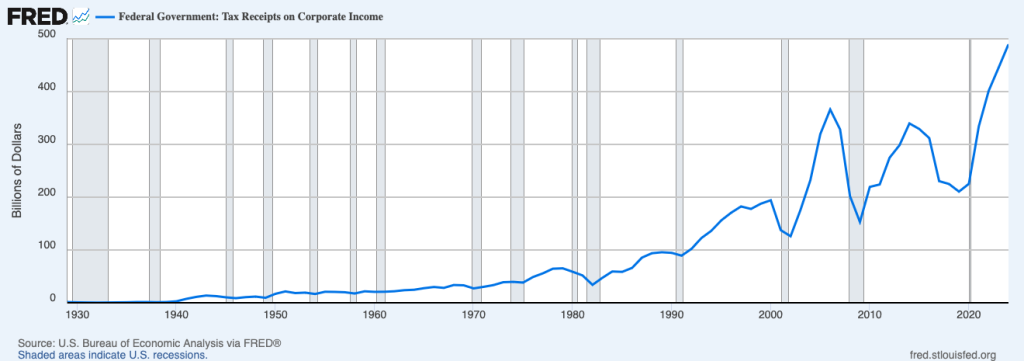

To illustrate how dire this situation is, here are several graphs from the St Louis Fed about the federal deficit and how fast and far it is increasing. The first is the total amount of debt. The second is the percent of Gross Domestic Product (GDP), a common measure of the relative size of the debt and a country’s ability to manage that debt. We’re the largest economy in the world so we can amass a huge amount of federal debt compared to other countries but that debt comes at a cost, for the year 2025 we will spend $1 trillion dollars on the interest for that debt in a budget of $5.7 trillion dollars. The next graph is the federal budget surplus or deficit, mostly deficit as one can see, and that deficit has only been in the plus column once in the past 50 years, hence the massive debt we’ve accumulated. For the year 2024, the federal government brought in revenues of $4.5 trillion dollars and spent $5.7 trillion. This is unsustainable under any scenario, the equivalent of using atomic bombs to dig financial holes over and over, every year becoming massively more in debt. The last graph is the amount of interest the government is paying which wasn’t onerous until 1960 when it started trending up, reflecting the persistent deficits that came to embody the country’s cavalier attitude to government debt. It really took off after 2008, the Great Recession, when the Keynesian approach to that crisis gave justification to massive bailouts. This was fine as long as the monies spent were reimbursed in following good economic times. They were not and the COVID crisis of 2020, with the massive expenditures for addressing the pandemic itself and more Keynesian economic stimulus, caused the deficit and the interest payments to skyrocket.

Now the answer in 2025 by Republicans to the Democrat’s profligacy in 2021 was to double down with a bill the drastically cut the government’s revenue with massive tax cuts while simultaneously increasing funding for preferred programs and pretending the resulting budget chasm wasn’t just that, a chasm. There could no starker a justification for a Balanced Budget Amendment than these past 5 years in US political history.

A Solution

A proposed solution is two fold: 1) Implement a credible, durable and balanced plan to reduce the debt over 10 years, using additional revenue along with reductions in government programs in order to share the burden, and 2) amend the Constitution to include a Balanced Budget Amendment that requires balanced budgets as federal debt exceeds 90% of GDP, a common measure of the level of government indebtedness. To be clear, the amendment does not prevent any borrowing by the government, just excessive borrowing, and even that can be done temporarily in case of emergency with a two thirds vote of Congress. It is the definition of limiting government, in this case the reckless piling up of debt that will have to be paid off by future generations, and a necessary companion to the government’s power to collect taxes.

The ideal nature of a debt reduction plan is to share the load across ALL aspects of the US while implementing policies that capture more of the revenue from a balanced taxation approach versus the polarized and often unfair reliance on income taxes, in other words implement what every other developed country uses, a consumption tax while reducing reliance on income taxes. Another advantage of a balanced budget amendment is that it will force elected leaders to work collaboratively and use consensus to reach compromise in achieving that balance.

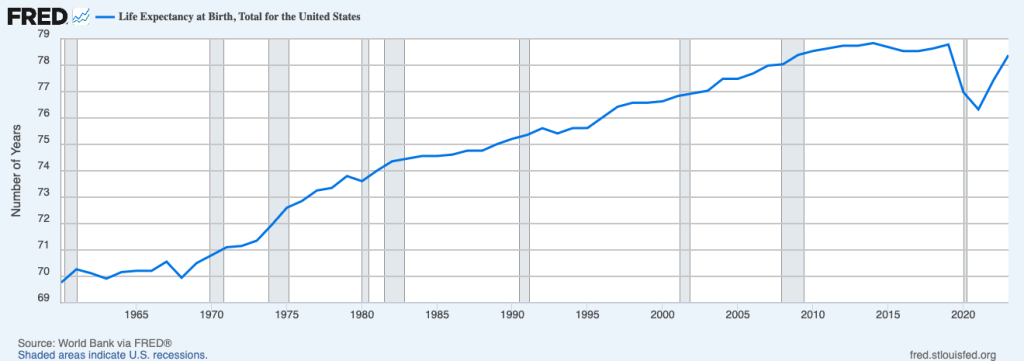

Inevitably there will be trade-offs in order to reduce spending by the government which will necessitate reductions in benefits and modifications in how those benefits are delivered. Some can be achieved by increased efficiency and eliminating misuse of services but others will have to address systemic issues that cause the inflation of the costs of these benefits. Entitlements incorporate inflation adjustments but do not recognize the reality that Americans are living longer and thus consuming more of these resources, while medicine is making huge strides in extending life but at a much higher cost. Adding mortality as an index to how benefits are administered should have been part of the original Social Security and Medicare bills, it’s a necessity now. Also, the cap for high income earners should be removed and the contribution limits raised.

It will also require the country to address its historical view of our defense department, a massive part of government spending, and our role in the world as a superpower based on the fact our military is the most powerful in human history. This cannot continue, at least not as it has to date. We cannot support a military that is predicated on the assumption we must fight a two theater war, we cannot support a military that has little if any control over the cost of its procurement and certainly little incentive to procure economically and efficiently, and we cannot continue an ethos of “going it alone” as an organizing principle. These issues with spending could be overlooked during the Cold War when there was an existential threat to the country, but that is no longer the case and our role as the only solution for the world’s defense of freedom should be replaced by a new reality that stresses ALL of our allies responsibility for defending freedom. The current administration recognizes that last part but not the first. As we reduce our commitments around the world, we must reduce the size of our military. We must also reform how it operates, adopting a motto of doing more with less and being far more efficient in husbanding its resources.

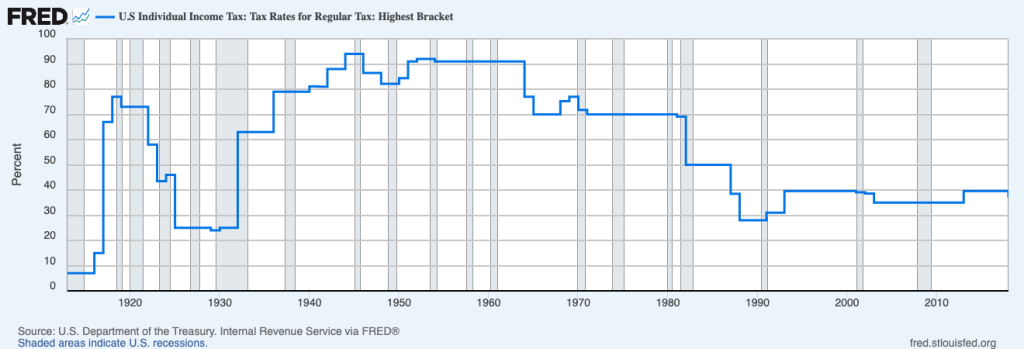

In terms of revenue, a proposed solution should address three realities: 1) the nature of our economy is that of significant wealth disparity, 2) one where that revenue is unbalanced in its sources, and 3) the US is the premier economy in the world, providing all manner of resources no other country can deliver, those resources should be reflected in the taxes paid by corporations. The first had been recognized and addressed for decades before 1980, the progressive nature of our tax system increased the amount of taxes collected from individuals as income went up to the higher tiers. After 1980, those income brackets were reduced and eliminated and the result was a skyrocketing of income inequality. Any solution should restore those higher income brackets while also eliminating loopholes that only the extremely wealthy can exploit in order to avoid paying taxes. In order to balance that action, we should also expand where we collect taxes and implement a consumption tax, similar to what every other developed country has. There should be credits and exemptions to balance their effects but countries far more left of the US have these taxes and found means of balancing the regressive nature of them. Lastly, the corporate tax rate should be raised to 30%, a fair compromise that balances the contributions the country provides for corporations with the incentives needed for a thriving and dynamic business environment.

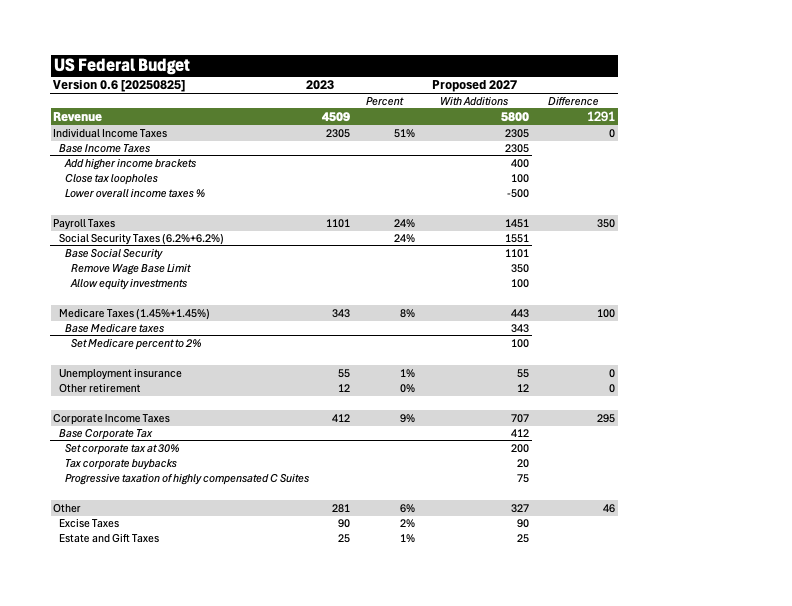

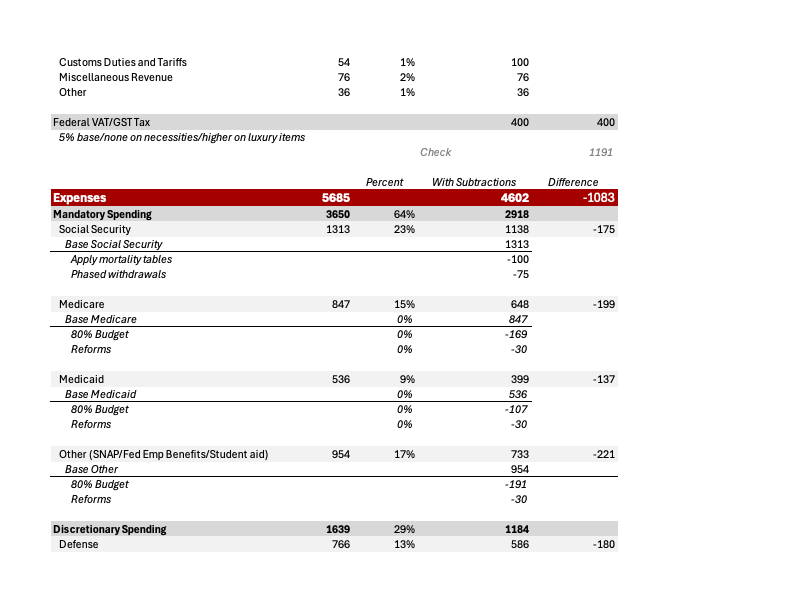

Below is a proposed federal budget for 2027. It will certainly cause angst among a wide range of Americans which is fine, the nature of compromise is a deal that both parties are unhappy with but will still grudgingly accept. It’s purpose is three-fold: a serious and comprehensive proposal to balance the budget, one that forces Americans to compromise in order to accomplish that goal, and one that establishes the foundations for a limited government, i.e. one that lives within its means.

References

Full Images